This remuneration report is a part of the management report.

Process for determining and implementing as well as reviewing the remuneration system for members of the Executive Board of Continental AG

The Supervisory Board determines the system for remuneration of the Executive Board in accordance with the legal regulations in Sections 87 (1) and 87a (1) of the German Stock Corporation Act (Aktiengesetz – AktG). The Supervisory Board is supported by its Chairman’s Committee in this respect. The Chairman’s Committee and the Supervisory Board can bring in external consultants where necessary. For the mandating thereof, care is taken to ensure they are independent of the Executive Board and the company.

The remuneration system resolved by the Supervisory Board is presented to the Annual Shareholders’ Meeting for approval. Should the Annual Shareholders’ Meeting not approve said remuneration system, a reviewed version of the remuneration system is presented for approval at the following Annual Shareholders’ Meeting at the latest, in accordance with Section 120a (3) AktG.

The Chairman’s Committee arranges for the regular review of the system for remuneration of the members of the Executive Board by the Supervisory Board. Where necessary, it recommends changes to the system to the Supervisory Board. For each substantial change to the remuneration system, but at least every four years, the remuneration system is to be presented to the Annual Shareholders’ Meeting for approval in accordance with Section 120a (1) Sentence 1 AktG.

New remuneration system as of January 1, 2020

The Supervisory Board reviews the Executive Board’s remuneration regularly. Most recently in 2019, it once again commissioned an independent consultant to review the remuneration of the Executive Board and the remuneration system, in order to take into account changes in the general conditions as a result of the German Act for the Implementation of the 2nd EU Shareholder Rights Directive (ARUG II) – which took effect on January 1, 2020 – and the new version of the German Corporate Governance Code of December 16, 2019 (published by the German Federal Ministry of Justice in the official section of the electronic Federal Gazette (Bundesanzeiger) on March 20, 2020). On the basis of reviews by the independent consultant, the Supervisory Board discussed the new remuneration system for the Executive Board in detail over several meetings and finalized this at its meeting on March 17, 2020. The new remuneration system was then approved by the Annual Shareholders’ Meeting of Continental AG on July 14, 2020.

The new system has applied to the remuneration of members of the Executive Board of Continental AG since January 1, 2020. This remuneration report describes the new remuneration system for the Executive Board as well as the structure and amount of the remuneration for individual members of the Executive Board.

Principles of the remuneration system

The remuneration system for members of the Executive Board of Continental AG makes a valuable contribution toward promoting the business strategy of Continental AG. Through the arrangements for the remuneration system, the members of the Executive Board will be motivated to achieve major strategic corporate targets – in particular, increasing the company’s value and holding a top market position with regard to customer focus, quality and market share.

When determining Executive Board members’ remuneration, the Supervisory Board focuses on the following principles:

Promotion of the corporate strategy

The remuneration system, in its entirety, makes a valuable contribution toward the promotion and implementation of the corporate strategy, by defining sustainable performance criteria relating to the long-term success of the company.

Appropriateness of the remuneration

The remuneration of the Executive Board members is proportionate to their tasks and performance. It takes into account the complexity and the economic position of the company. Compared to similar companies, the remuneration is in line with the market and, at the same time, competitive.

Linking of remuneration to performance

The remuneration of members of the Executive Board is linked to their performance, whereby the variable remuneration component is dependent on specific target criteria being met. Outstanding performance is therefore reflected accordingly in the Executive Board member’s remuneration, while failure to meet the predefined targets will result in a noticeable reduction in their remuneration.

Focus on sustainable and long-term development of the company

The remuneration of the members of the Executive Board is geared toward the sustainable and long-term development of the company. The major portion of the variable remuneration component is therefore measured over several years. As part of the long-term variable remuneration component, the members of the Executive Board are also given non-financial target criteria for the sustainable development of the company.

Harmonization with shareholder and stakeholder interests

The remuneration system makes a key contribution toward linking the interests of the Executive Board with the interests of shareholders and other stakeholders. The major portion of the variable remuneration component is linked to the performance of the company and the Continental share price. In addition, the Executive Board commits to acquire and permanently hold shares in Continental AG during its appointment.

Consistency of the remuneration system

The remuneration system for members of the Executive Board is linked to the remuneration of the Continental Group’s managers, sets comparable incentives and presents a set of harmonized targets.

Overview: components and structure of total target-based remuneration

The remuneration system comprises a fixed component that is unrelated to performance as well as a variable component that is based on performance.

The fixed component that is unrelated to performance comprises the fixed annual salary, additional benefits and future benefit rights.

The variable component that is based on performance comprises a short-term remuneration component (performance bonus without equity deferral) as well as long-term remuneration components (long-term incentive and equity deferral of the performance bonus). For the variable remuneration components, before the start of each fiscal year, target criteria are determined by the Supervisory Board with a view to its strategic goals, the provisions of Sections 87 and 87a AktG and the German Corporate Governance Code in its respective valid version, whereby the degree to which these criteria are met will determine the actual amount paid out.

The Supervisory Board may take the function and area of responsibility of the individual members of the Executive Board into account accordingly when determining the amount of the total target-based remuneration. As part of this, shares of the individual remuneration component for the total target-based remuneration are indicated below in percentage ranges. The precise proportions therefore vary depending on the functional differentiation as well as a possible change within the framework of the yearly remuneration review.

The fixed annual salary comprises 22% to 28% of the target remuneration, the performance bonus (excluding equity deferral) between 17% and 22%, and the equity deferral and long-term incentive between 33% and 38%. Future benefit rights make up between 17% and 23% of the target remuneration, and additional benefits make up approximately 1%.

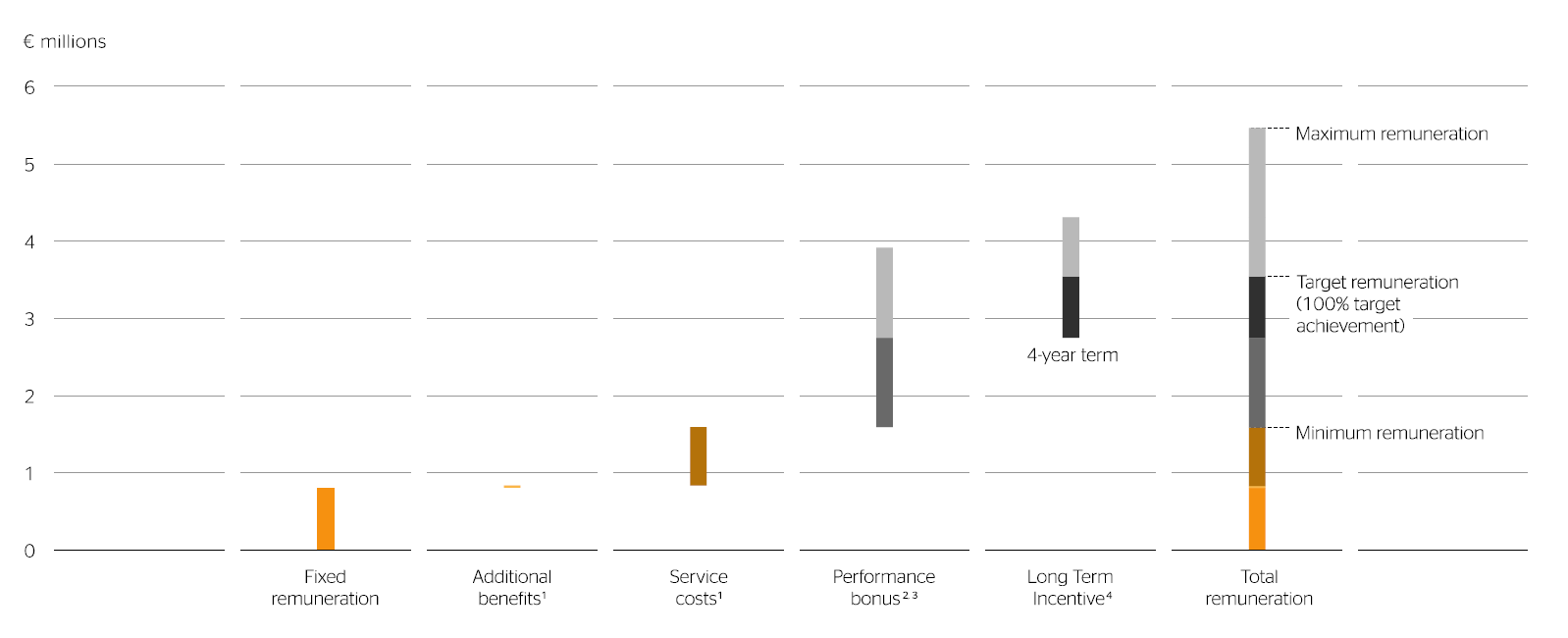

Remuneration of an Executive Board Member responsible for a Business Area (example)

1 Average figure for 2020.

2 Based on a target amount (here €1.167 million) for 100% achievement of defined EBIT, ROCE and FCF targets as well as a personal contribution factor (PCF) of 1.0. A maximum of 200% of the target amount can be achieved.

3 From the net inflow of the performance bonus, shares of Continental AG with a value of 20% of the gross payout amount must be purchased and held for a period of three years.

4 Based on the allotment value, which is converted into virtual shares of Continental AG. The payment amount depends on the relative total shareholder return, the sustainability criteria achieved and the share price before the payment. A maximum of 200% of the allotment value can be achieved.

Remuneration Components in Detail

1. Fixed remuneration component

The fixed annual salary is a fixed remuneration for the entire fiscal year that is paid out in 12 equal monthly installments.

Each member of the Executive Board also receives additional benefits, including:

- Provision of a company car, which can also be for personal use

- Reimbursement of travel expenses, as well as relocation costs and expenses for running a second household, where this is required for work reasons

- A regular health check

- Directors’ and officers’ (D&O) liability insurance with deductible in accordance with Section 93 (2) Sentence 3 AktG

- Group accident insurance

- The employers’ liability insurance association contribution including, where necessary, income tax incurred as a result, as well as

- Health insurance and long-term care insurance contributions based on Section 257 of Book V of the German Social Code (SGB V) and Section 61 of Book XI of the German Social Code (SGB XI)

Each member of the Executive Board is granted post-employment benefits that are paid starting at the age of 63, but not before they leave the service of Continental AG (hereinafter “insured event”). From January 1, 2014, the company pension for the members of the Executive Board was changed to a defined contribution commitment. A capital component is credited to the Executive Board member’s pension account each year. In addition, a fixed contribution, agreed by the Supervisory Board in the Executive Board member’s employment contract, is multiplied by an age factor that represents an appropriate return. For members of the Executive Board who were already in office prior to January 1, 2014, the future benefit rights accrued until December 31, 2013, have been converted into a starting component in the capital account. When the insured event occurs, the benefits are paid out as a lump sum, in installments or – as is normally the case due to the expected amount of the benefits – as a pension. Post-employment benefits are adjusted after commencement of such benefit payments in accordance with Section 16 of the German Company Pensions Law (Betriebsrentengesetz – BetrAVG).

2. Variable remuneration component

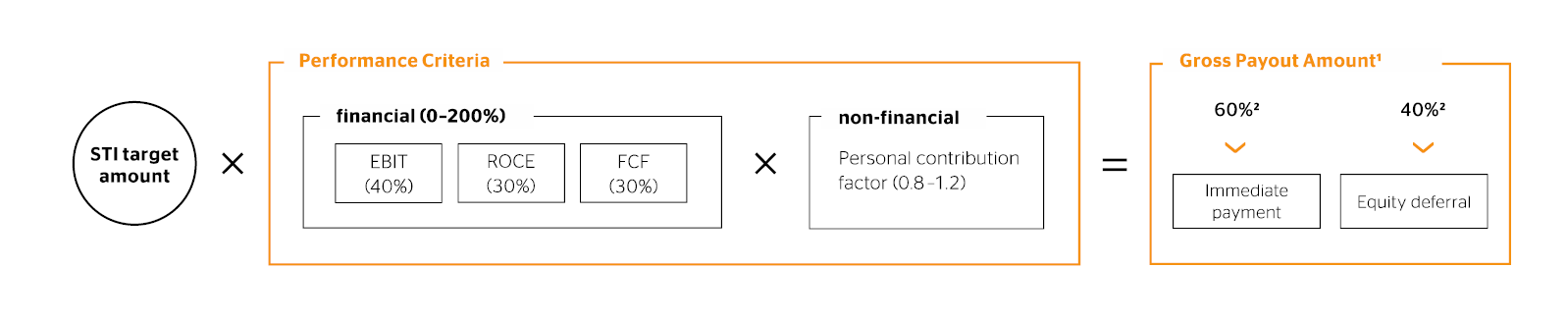

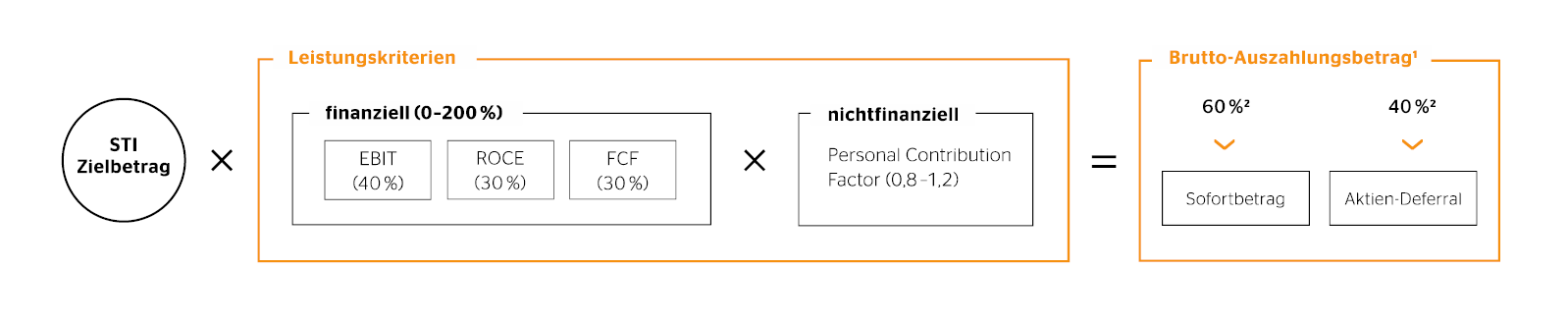

a) Performance bonus (short-term incentive, STI)

In the employment contract, the Supervisory Board agrees to a target amount for the performance bonus (hereinafter “STI target amount”) that is granted to each member of the Executive Board in the event of 100% target achievement. The maximum amount of the performance bonus is limited to 200% of the STI target amount.

The amount of the STI to be paid out depends on the extent to which a member of the Executive Board achieves the targets set by the Supervisory Board for this Executive Board member for the following three key financial indicators as performance criteria within the meaning of Section 87a (1) Sentence 2 No. 4 AktG:

- Earnings before interest and tax (hereinafter “EBIT”), adjusted for goodwill impairment as well as gains and/or losses from the disposal of parts of the company

- Return on capital employed (hereinafter “ROCE”) as the ratio of EBIT (adjusted, as mentioned above) to average operating assets for the fiscal year

- Cash flow arising from operating activities and cash flow (hereinafter “free cash flow” or “FCF”), adjusted for cash inflows and outflows from the disposal or acquisition of companies and business operations

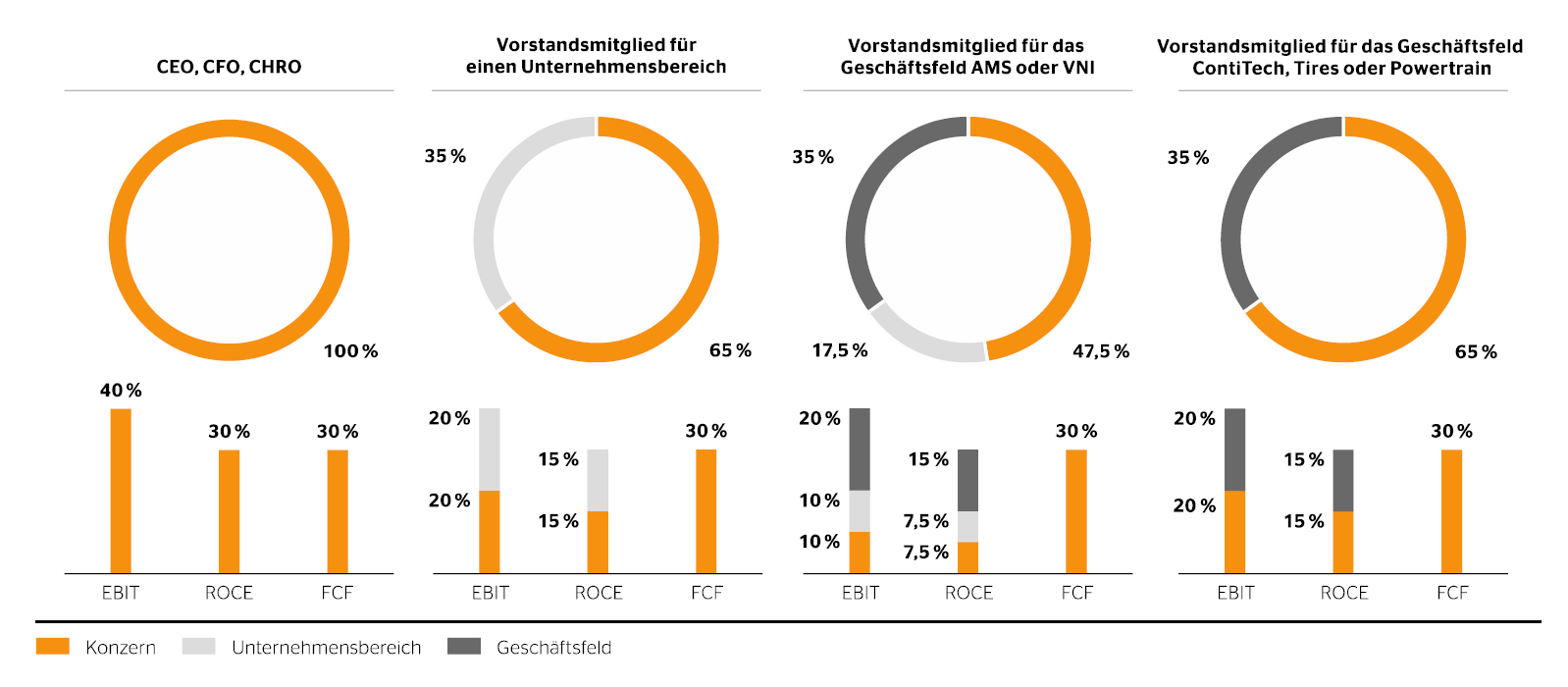

The degree to which the EBIT target is achieved is weighted at 40%, the ROCE target at 30% and the free cash flow target at 30% in the calculation of the STI.

For each financial performance criterion, the target value for 100% target achievement corresponds to the value that the Supervisory Board agreed in each case for this financial performance criterion in the planning for the respective fiscal year.

For each financial performance criterion, the Supervisory Board determines the values for target achievement of 0% and 200% on an annual basis. The degree to which the target is achieved is calculated on a straight-line basis between 0% and 200% by comparing this with the respective actual value for the fiscal year.

A subsequent change to target values and the comparison parameters is – subject to the options described below for dealing with extraordinary events and developments – not possible.

In addition, prior to the start of each fiscal year, the Supervisory Board can determine personal, non-financial performance criteria to be included in target achievement in the form of a personal contribution factor (hereinafter “PCF”) with a value between 0.8 and 1.2 for individual or all members of the Executive Board from the following areas:

- Market development and customer focus (e.g. new markets, new product or customer segments)

- Implementation of transformation projects (e.g. spin-off, portfolio adjustments, reorganization, efficiency enhancements, strategic alliances)

- Organizational and cultural development (e.g. promotion of corporate values, agility and ownership, strengthening of internal cooperation and communication, succession planning, employer brand)

Structure of the performance bonus (STI)

1 A maximum of 200% of the target amount can be achieved.

2 Net amount; from the net inflow of the performance bonus, shares of Continental AG with a value of 20% of the gross payout amount must be purchased and held for a period of three years; the corresponding gross amount was calculated assuming a tax and contribution ratio of 50% flat.

The non-financial performance criteria and target achievement for the PCF should be understandable and verifiable. After the end of the fiscal year, the Supervisory Board assesses the performance of the individual member of the Executive Board based on the set performance criteria and targets, and determines a value between 0.8 and 1.2 for the PCF.

If the Supervisory Board has not set any targets for the PCF for a fiscal year, the PCF value is 1.0.

The financial and non-financial performance criteria for the performance bonus are intended to incentivize the members of the Executive Board to create value and to achieve or even exceed the short-term economic goals as well as motivate them to attain operational excellence. The PCF also allows the Supervisory Board to take into account the individual or collective achievements of the Executive Board members, based on non-financial performance criteria and goals, that are decisive for the operational implementation of the corporate strategy.

The performance bonus is intended firstly to reflect the overall responsibility for the company of the members of the Executive Board and promote collaboration among the group sectors, and secondly to provide independent leadership for the respective areas. When determining the targets and calculating the STI for each member of the Executive Board, the respective business responsibility is therefore taken into account as follows:

- For an Executive Board member whose area of responsibility extends to the Continental Group as a whole – e.g. chief executive officer (CEO), chief financial officer (CFO), chief human relations officer (CHRO) – achievement of the EBIT and ROCE targets is measured based on the key figures determined for the Continental Group.

- For an Executive Board member whose area of responsibility consists of a group sector (e.g. chairman of the Automotive Board), achievement of the EBIT and ROCE targets is measured based on the key figures determined for the Continental Group and for the group sector (50% each).

- For an Executive Board member whose area of responsibility consists of the Autonomous Mobility and Safety (AMS) or Vehicle Networking and Information (VNI) business area, achievement of the EBIT and ROCE targets is measured based on the key figures determined for the Continental Group (25%), for Automotive Technologies (25%) and for the respective business area (50%).

- For an Executive Board member whose area of responsibility consists of the ContiTech, Tires or Powertrain business area, the extent to which the EBIT and ROCE targets have been achieved is measured on the basis of the key figures determined for the Continental Group (50%) and for the respective business area (50%).

- Achievement of the free cash flow target is measured for all Executive Board members based on free cash flow for the Continental Group as a whole.

After the end of the fiscal year, the target achievement for each financial performance criterion is calculated on the basis of the audited consolidated financial statements of Continental AG and multiplied by the STI target amount in accordance with the weighting described below. By multiplying this result by the PCF, the gross value of the STI amount to be paid (hereinafter “gross payout amount”) is determined. A special or recognition bonus cannot be granted to the Supervisory Board.

Each member of the Executive Board is obligated to invest 20% of the gross payout amount (generally corresponding to around 40% of the net payment amount) in shares of Continental AG. The remainder is paid out as short-term variable remuneration.

The purchase of shares is to take place through an external service provider within a defined timeframe after the settlement and provision of the amount, taking into consideration the statutory provisions that apply in each case, in particular the statutory regulations on insider business (starting from Art. 7 of the EU Market Abuse Regulation) and managers’ transactions (Art. 19 of the EU Market Abuse Regulation). Each member of the Executive Board is obligated to hold the shares legally and economically for a period of at least three years from the day of acquisition. The shares acquired as deferral can be counted toward the obligation of the Executive Board member to acquire shares of Continental AG in accordance with the share ownership guideline presented below.

b) Long-term incentive (LTI)

In the financial report as at September 30, 2020, the long-term incentive plan from the new remuneration system was described as the Continental long-term incentive plan (CLIP 2020). In the following, this will be referred to as the 2020 LTI plan. The long-term incentive (hereinafter “LTI”) is intended to promote the long-term commitment of the Executive Board to the company and its sustainable growth. Therefore, the long-term total shareholder return (hereinafter “TSR”) of Continental shares, compared with an index consisting of European companies that are active in the automotive and tire industry and comparable with Continental AG (STOXX Europe 600 Automobiles & Parts (SXAGR); hereinafter “benchmark index”), is a key performance criterion for the LTI. The second performance criterion is a sustainability score that is multiplied by the degree of target achievement in order to calculate the LTI to be paid. The amount of the LTI to be paid is based on the performance of the Continental share price over the term of the LTI.

Each LTI has a term of four fiscal years. In the employment contract, the Supervisory Board agrees to an allotment value in euros for the LTI with each member of the Executive Board. At the start of the first fiscal year of the term of the LTI plan, this allotment value is converted into a basic holding of virtual shares. The allotment value is divided by the arithmetic mean of Continental AG’s closing share prices in Xetra trading on the Frankfurt Stock Exchange (or a successor system) in the last two months prior to the start of the term of the respective LTI plan (issue price).

The maximum amount of the LTI to be paid is limited to 200% of the allotment value, which is set out in the employment contract for the respective member of the Executive Board.

For the calculation of the relative TSR, after the four-year term of the LTI plan, the TSR on Continental shares (Continental TSR) is compared with the performance of the benchmark index over this time period. If the Continental TSR corresponds to the benchmark TSR, the TSR target is 100% achieved.

If the Continental TSR falls short of the benchmark TSR by 25 percentage points or more, the target achievement is 0%. If the Continental TSR exceeds the benchmark TSR by 25 percentage points or more, the target achievement is 150%. If the Continental TSR falls short of, or exceeds, the benchmark TSR by fewer than 25 percentage points, the degree to which the targets are achieved is calculated on a straight-line basis between 50% and 150%. A target achievement of more than 150% is excluded.

The Supervisory Board sets out appropriate provisions in the event of changes to Continental’s share capital, the listing of the Continental share or the benchmark index that have a substantial impact on the Continental TSR or the benchmark TSR.

Sustainability is an integral part of the corporate strategy at Continental and is based on the four company values of Trust, Passion To Win, Freedom To Act and For One Another. For Continental, sustainability means having a positive impact on society and reducing any negative impact of business operations.

The Executive Board of Continental AG approved a new sustainability strategy in fiscal 2019, which the Supervisory Board is integrating into the remuneration system. The Executive Board’s sustainability strategy defines 12 material topics: climate protection, clean mobility, circular economy, sustainable supply chains, green and safe factories, good working conditions, product quality, corporate governance, innovation and digitalization, safe mobility, long-term profitability, and corporate citizenship. From these, the Executive Board has identified the following strategic focus areas:

- Climate protection

- Clean mobility

- Circular economy

- Sustainable supply chains

The Executive Board of Continental AG has set ambitious sustainability goals based on these four topics. The necessary concepts, performance indicators and individual targets are being developed successively.

Based on the current concepts, performance indicators and individual targets for the 12 topics, in particular the strategic focus areas, the Supervisory Board sets out up to six performance criteria and targets for the sustainability score of the respective LTI plan. These can be targets for CO2 emissions and recycling quotas or the review of good working conditions for employees in the Continental Group (e.g. based on sick leave or accident rates).

When determining the performance criteria for the sustainability score, the Supervisory Board pays particular attention to the availability of data required at the corporate level, data quality and its comparability over time, but also the degree to which achievement of targets is influenced by management performance. The target achievement should also be verifiable, as part of the audit of the non-financial statement.

The Supervisory Board reviews the extent to which targets have been achieved on the basis of the reviewed consolidated financial statements and the non-financial statement of the Continental Group for the fourth fiscal year of the term of the LTI plan.

For the calculation of the sustainability score, to the value of 0.7 for each target that has been achieved, a value is added that is determined by dividing 0.6 by the number of determined performance criteria. The sustainability score can be no higher than 1.3. For the calculation of the LTI to be paid out, the relative TSR and the sustainability score for the performance index (hereinafter “PI”) are first multiplied together. By multiplying the basic holding of virtual shares with the PI, this results in the final holding of virtual shares.

The final holding of virtual shares is multiplied by the payout ratio in order to determine the gross amount of the LTI to be paid out in euros (hereinafter “payout amount”). The payment ratio is the sum of the arithmetic mean of Continental AG’s closing share prices in Xetra trading on the Frankfurt Stock Exchange (or a successor system) on the trading days in the last two months prior to the next ordinary Annual Shareholders’ Meeting that follows the end of the term of the LTI plan and the dividends paid out per share during the term of the LTI plan.

The payout amount may not exceed 200% of the allotment value agreed in the employment contract.

If the employment contract for a member of the Executive Board ends without good cause before the end of the first fiscal year of an LTI plan, the Executive Board member is entitled to an LTI that is reduced pro rata temporis. If the employment contract for a member of the Executive Board ends without good cause after the end of the first fiscal year but before the end of the term of an LTI plan, the Executive Board member remains entitled to the full LTI. The other conditions of the LTI do not change; in particular, the time of calculation and the maturity date of the payment remain unchanged. No entitlement to payment of an LTI, or to payment of a pro rata LTI, exists in the event of premature termination of the employment contract for good reason.

Determining the specific total target-based remuneration

The Supervisory Board determines, in accordance with the remuneration system, the amount of total target-based remuneration for each member of the Executive Board for the coming fiscal year in each case. As a guide, the respective remuneration is appropriately proportionate to the tasks and performance of the member of the Executive Board as well as the location of the company, should not exceed the usual remuneration without good cause, and is geared toward a long-term and sustainable development of Continental AG. For this purpose, comparative observations are employed, both externally and internally:

- Horizontal (external) comparison: To assess the appropriateness and conventionality of the specific total remuneration for the members of the Executive Board compared with other companies, the Supervisory Board consults a suitable benchmark group (horizontal comparison). For this peer group comparison, the market position of the companies compared with Continental AG is a decisive factor. In this respect, the companies of the German stock index (DAX) form a comparative market within which the total target-based remuneration and maximum remuneration in particular are compared.

- Vertical (internal) comparison: The vertical comparison refers to the ratio of the Executive Board remuneration to the remuneration of senior executives and the workforce in the Continental Group in Germany, with development over time also taken into account. For this purpose, the Supervisory Board defined senior executives as comprising the management levels below the Executive Board of Continental AG within the Continental Group which, according to the internal job evaluation system, are part of the group of senior executives. The rest of the workforce specifically includes the circle of executives, likewise defined in accordance with the internal job evaluation system, as well as the group of non-tariff employees and the group of tariff employees.

- Differentiation based on the respective job specifications: The remuneration system allows the Supervisory Board to take the function and area of responsibility of the individual members of the Executive Board into account accordingly when determining the amount of the total target-based remuneration. In the professional judgment of the Supervisory Board, function-specific differentiations are therefore permitted, whereby criteria such as customary market practice, experience of the relevant Executive Board member, and the area for which they have responsibility are taken into account.

- Maximum remuneration amounts: The variable remuneration is intended to guarantee a balanced risk-opportunity profile. If the set targets are not achieved, the payment amount of the variable remuneration can be reduced to zero. If the targets are significantly exceeded, the payment for both the short-term and the long-term variable remuneration components is limited to 200% of the target amount or allotment value.

In addition, the Supervisory Board set out a ceiling for all remuneration components combined, including additional benefits and service costs, in accordance with Section 87a (1) Sentence 2 No. 1 AktG (hereinafter “maximum remuneration”). The maximum remuneration is €11.5 million for the chief executive officer, €6.7 million for the chief financial officer and the chief human relations officer, and €6.2 million for the other members of the Executive Board. These ceilings refer, in each case, to the sum of all payments resulting from the remuneration provisions for a fiscal year.

Further remuneration-relevant provisions

1. Malus and clawback provision

If an Executive Board member, in their function as a member of the Executive Board, commits a demonstrably deliberate gross infringement of their duty of care as set out in Section 93 AktG, of a significant principle for action in the internal guidelines introduced by the company, or of one of their other obligations as set out in the employment contract, the Supervisory Board can, at its due discretion, wholly or partially reduce the variable remuneration that is to be granted for the fiscal year in which the gross infringement took place to zero (hereinafter “malus provision”).

If the variable remuneration has already been paid out at the time the decision is made to impose a reduction, the members of the Executive Board must pay back the excess payments received in accordance with this decision (hereinafter “clawback provision”). In this case, the company is also entitled to charge for other remuneration claims of the member of the Executive Board.

Any claims for damages of Continental AG against the member of the Executive Board, in particular from Section 93 (2) AktG, will remain unaffected by the agreement of a malus or clawback provision.

2. Share ownership guideline

In addition to the remuneration components already mentioned, each member of the Executive Board is required to invest a minimum amount in Continental AG shares and to hold these shares during their term of office plus an additional two years after the end of their appointment and the end of their employment contract.

The minimum amount to be invested by each member of the Executive Board is based on their agreed gross fixed annual salary. It amounts to 200% of the fixed annual salary of the chief executive officer and 100% of the fixed annual salary of all other members of the Executive Board.

For the duration of the mandatory holding period, a member of the Executive Board may neither pledge Continental shares acquired in accordance with the share ownership guideline nor otherwise hold them.

3. Terms and termination options

The employment contracts do not plan for an ordinary termination option; the mutual right for extraordinary termination of the employment contract for good cause remains unaffected. Continued remuneration payments have been agreed for a certain period in the event of incapacitation through no fault of the Executive Board member concerned. If a member of the Executive Board becomes permanently unable to work during the term of their employment contract, the employment contract will end on the day on which the permanent inability to work is identified.

In the event of premature termination of Executive Board work without good cause, payments to be agreed where necessary that are made to the member of the Executive Board, including added benefits, shall not exceed the value of two annual salaries (hereinafter “severance cap”) or the value of remuneration for the remaining term of the employment contract of the Executive Board member. For the calculation of the severance cap, the total remuneration for the past fiscal year is taken into account, and if necessary also the expected total remuneration for the current fiscal year.

For each member of the Executive Board, a post-contractual non-compete covenant is agreed for a duration of two years. Over this period of time, appropriate compensation (compensation for non-competition) is granted at an amount of 50% of the most recently contractually agreed benefits each year. Any severance payment is to be credited against the compensation for non-competition.

The remuneration system does not allow for special provisions in the event of a change of control or redundancy payment commitments.

4. Dealing with extraordinary events and developments

The Supervisory Board may, at the recommendation of the Chairman’s Committee, temporarily deviate from parts of the remuneration system for the Executive Board in extraordinary cases, where this is appropriate and necessary in order to maintain the incentivizing effect of the remuneration for members of the Executive Board in the interests of the company in the long term, the remuneration of members of the Executive Board continues to be geared toward sustainable and long-term development of the business, and the financial strength of the company is not overstretched. Extraordinary developments may be, for example, extraordinary and far-reaching changes to the economic situation (as a result of a major economic crisis, for example) that can make the original target criteria and/or financial incentives of the remuneration system redundant, provided these or the specific effects that they have were not foreseeable. Market developments that are generally unfavorable are expressly not considered to be extraordinary developments.

The parts of the remuneration system from which deviations can occur are the process, the provisions on the structure and amount of remuneration, as well as the individual remuneration components. If making an amendment to the existing remuneration components is not sufficient to restore the incentive effect of the remuneration for the member of the Executive Boards, the Supervisory Board has the right, in the event of extraordinary developments and under the same conditions, to temporarily grant additional remuneration components.

A deviation from, or addition to, the remuneration components is only possible thanks to a corresponding resolution of the Supervisory Board on a previous proposal by the Chairman’s Committee that approves the extraordinary circumstances and the need for a deviation or addition here.

Remuneration system prior to December 31, 2019

The remuneration system in place until December 31, 2019, (hereinafter “2019 remuneration system”) continues to have an impact on the remuneration of both serving and former members of the Executive Board, in particular in relation to the long-term incentives, equity deferral and future benefit rights granted until the end of 2019. In addition, the remuneration of Dr. Elmar Degenhart was based on the 2019 remuneration system until he left the Executive Board of Continental AG on November 30, 2020. The key elements from the 2019 remuneration system are therefore described below.

Remuneration for Executive Board members as set out in the 2019 remuneration system consisted of the following:

- Fixed remuneration

- Variable remuneration elements

- Additional benefits

- Retirement benefits

1. Fixed remuneration

Each Executive Board member received fixed annual remuneration paid in 12 monthly installments. The fixed remuneration, with 100% target achievement of the variable remuneration elements, made up around one-third of the direct remuneration.

2. Variable remuneration elements

The Executive Board members also received variable remuneration in the form of a performance bonus and a share-based long-term incentive (LTI). A key criterion for measuring variable remuneration was the Continental Value Contribution (CVC) (please refer to the Corporate Management section in the management report, page 49). The variable remuneration elements, with 100% target achievement, made up around two-thirds of the direct remuneration. The structure of the variable remuneration was geared toward the sustainable development of the company, with a future-oriented assessment basis that generally covered several years. The share of long-term components amounted to 60% or more of variable remuneration on the basis of the target values.

a) Performance bonus

The performance bonus was based on a target amount that the Supervisory Board determined for each Executive Board member for 100% target achievement. Target criteria were the year-on-year change in the CVC and the return on capital employed (ROCE). For Executive Board members with responsibility for a particular business area, these criteria related to the relevant business area; for other Executive Board members, they related to the Continental Group. The CVC target was 100% achieved if the CVC was unchanged compared to the previous year. If the CVC fell or rose by a defined percentage, this element was reduced to zero or reached a maximum of 150%. In the case of negative CVC in the previous year, target achievement was based on the degree of improvement. The criteria for the ROCE target were guided by planning targets. This component could also be omitted if a certain minimum value was not achieved.

The CVC target was weighted at 60% and the ROCE target at 40% in the calculation of the performance bonus. In addition to the CVC and ROCE targets, the Supervisory Board could determine a strategic target at the beginning of each fiscal year, which was weighted at 20% – reducing the weighting of the other two targets accordingly. This option was not made use of for fiscal 2020. In order to take into account extraordinary factors that influenced the degree to which targets were achieved, the Supervisory Board had the right – as it saw fit – to retroactively adjust the established attainment of goals on which the calculation of the performance bonus was based by up to 20% downward or upward. It did not make use of the discretionary power. In any event, the performance bonus was capped at 150% of the target bonus. This applied irrespective of whether an additional strategic target was resolved.

The performance bonus achieved in a fiscal year was divided into a lump sum, which was paid out as an annual bonus (immediate payment), and a deferred payment (deferral). The immediate payment amounted to 60% and the deferral 40%. The deferral was converted into virtual shares of Continental AG. Following a holding period of three years after the end of the fiscal year for which the respective performance bonus was determined, the value of these virtual shares was paid out together with the value of the dividends that were distributed for the fiscal years of the holding period. The conversion of the deferral into virtual shares and payment of their value after the holding period were based on the average share price for the three-month period immediately preceding the Annual Shareholders’ Meeting in the year of conversion or payment. The possible increase in the value of the deferral was capped at 250% of the initial value. Future payments of the value of deferrals will still be made under the 2019 remuneration system, provided the three-year holding period for the virtual shares has expired.

b) Long-term incentive (LTI)

The LTI plan was resolved by the Supervisory Board on an annual basis with a term of four years in each case. It determined the target bonus to be paid for 100% target achievement for each Executive Board member, taking into account the Continental Group’s earnings and the member’s individual performance.

The first criterion for target achievement was the average CVC that the Continental Group actually generated in the four fiscal years during the term, starting with the fiscal year in which the tranche was issued. This value was compared to the average CVC, which was set in the strategic plan for the respective period. The degree to which this target was achieved could vary between 0% and a maximum of 200%. The other target criterion was the total shareholder return (TSR) on Continental shares during the term of the tranche. To determine the TSR, the average price of the Continental share in the months from October to December was set in relation to the beginning and the end of the respective LTI tranche. In addition, all dividends paid during the term of the LTI tranche were taken into account for the TSR (please refer to Note 28 of the notes to the consolidated financial statements). The degree to which this target was achieved was multiplied by the degree to which the CVC target was achieved to determine the degree of target achievement on which the LTI that would actually be paid after the end of the term was based. The maximum payment amount was capped at 200% of the target bonus.

Future payments of the LTI tranches issued may still be made under the 2019 remuneration system.

3. Additional benefits

Executive Board members also received additional benefits, primarily the reimbursement of expenses, including any relocation expenses and payments – generally for a limited time – for a job-related second household, the provision of a company car, and premiums for group accident and directors’ and officers’ (D&O) liability insurance. As a rule, members of the Executive Board were required to pay taxes on these additional benefits.

Continued remuneration payments were also agreed for a certain period in the event of employment disability through no fault of the Executive Board member concerned.

4. Retirement benefits

All members of the Executive Board were granted post-employment benefits that were paid starting at the age of 63 (but not before they left the service of the company) or in the event of disability.

From January 1, 2014, the company pension for the members of the Executive Board was changed from a purely defined benefit to a defined contribution commitment. A capital component was credited to the Executive Board member’s pension account each year. To determine this, an amount equivalent to 20% of the sum of the fixed remuneration and the target value of the 2019 performance bonus was multiplied by an age factor representing an appropriate return. The future benefit rights accrued until December 31, 2013, were converted into a starting component in the capital account. When the insured event occurred, the benefits were paid out as a lump sum, in installments or – as was normally the case due to the expected amount of the benefits – as a pension. Post-employment benefits were adjusted after commencement of such benefit payments in accordance with Section 16 of the German Company Pensions Law (Betriebsrentengesetz – BetrAVG).

In the employment contracts under the 2019 remuneration system, it was agreed that, in the event of premature termination of Executive Board work, payments to the Executive Board member that were to be agreed, including the additional benefits, would not exceed the value of two annual salaries or the value of remuneration for the remaining term of the employment contract for the Executive Board member. There were no compensation agreements with the members of the Executive Board in the event of a takeover bid or a change of control at the company. Dr. Ralf Cramer, who left the Executive Board on August 11, 2017, received compensation for non-competition for a post-contractual non-compete covenant that was in place until August 11, 2019. The calculation of this compensation was subsequently corrected due to a claim adjustment for the long-term component of the 2016 performance bonus and the 2016 LTI plan, and an amount of €361 thousand was therefore reclaimed. José A. Avila, who left the Executive Board on September 30, 2018, and whose employment contract ended on December 31, 2019, received compensation for non-competition in the amount of €789 thousand from January 1, 2020, for a post-contractual non-compete covenant that was still in place.

Dr. Elmar Degenhart, who left the Executive Board on November 30, 2020, received compensation for non-competition in the amount of €87 thousand from December 1, 2020, for a post-contractual non-compete covenant that was still in place.

Individual remuneration

In the tables below, the benefits, inflows and service costs granted to the members of the Executive Board are shown separately in accordance with the recommendations of Section 4.2.5 (3) of the German Corporate Governance Code as amended on February 7, 2017.

| N. Setzer (Chairman since December 1, 2020) | ||||||

|---|---|---|---|---|---|---|

| Remuneration granted | Inflows | |||||

| € thousands | 2019 | 2020 | 2020 (Min) | 2020 (Max) | 2019 | 2020 |

| Fixed remuneration | 800 | 828 | 828 | 828 | 800 | 828 |

| Additional benefits | 19 | 15 | 15 | 15 | 19 | 15 |

| Total | 819 | 843 | 843 | 843 | 819 | 843 |

| Performance bonus (immediate payment) | 700 | 768 | 0 | 1,536 | 209 | 84 |

| Multiannual variable remuneration | 1,250 | 1,359 | 0 | 2,718 | 517 | 342 |

| Performance bonus (deferral) [3 years] | 467 | — | — | — | 517 | 286 |

| Performance bonus (deferral) [2020]1 | — | 512 | 0 | 1,024 | — | 56 |

| Long-term incentive [4 years] | 783 | 847 | 0 | 1,694 | 0 | 0 |

| Total | 2,769 | 2,970 | 843 | 5,097 | 1,545 | 1,269 |

| Service costs | 737 | 999 | 999 | 999 | 737 | 999 |

| Total remuneration | 3,506 | 3,969 | 1,842 | 6,096 | 2,282 | 2,268 |

| Dr. E. Degenhart (Chairman from August 12, 2009, to November 30, 2020) | ||||||

|---|---|---|---|---|---|---|

| Remuneration granted | Inflows | |||||

| € thousands | 2019 | 2020 | 2020 (Min) | 2020 (Max) | 2019 | 2020 |

| Fixed remuneration | 1,450 | 1,281 | 1,281 | 1,281 | 1,450 | 1,281 |

| Additional benefits | 21 | 20 | 20 | 20 | 21 | 20 |

| Total | 1,471 | 1,301 | 1,301 | 1,301 | 1,471 | 1,301 |

| Performance bonus (immediate payment) | 1,500 | 1,373 | 0 | 2,059 | 270 | 0 |

| Multiannual variable remuneration | 2,550 | 1,270 | 0 | 2,998 | 909 | 403 |

| Performance bonus (deferral) [3 years] | 1,000 | 915 | 0 | 2,288 | 909 | 403 |

| Long-term incentive [4 years] | 1,550 | 355 | 0 | 710 | 0 | 0 |

| Total | 5,521 | 3,944 | 1,301 | 6,358 | 2,650 | 1,704 |

| Service costs | 1,293 | 1,443 | 1,443 | 1,443 | 1,293 | 1,443 |

| Total remuneration | 6,814 | 5,387 | 2,744 | 7,801 | 3,943 | 3,147 |

| J. A. Avila (Powertrain from January 1, 2010 to September 30, 2018) | ||||||

|---|---|---|---|---|---|---|

| Remuneration granted | Inflows | |||||

| € thousands | 2019 | 2020 | 2020 (Min) | 2020 (Max) | 2019 | 2020 |

| Fixed remuneration | — | — | — | — | — | — |

| Additional benefits | — | — | — | — | — | — |

| Total | — | — | — | — | — | — |

| Performance bonus (immediate payment) | — | — | — | — | — | — |

| Multiannual variable remuneration | — | — | — | — | 541 | 207 |

| Performance bonus (deferral) [3 years] | — | — | — | — | 541 | 207 |

| Long-term incentive [4 years] | — | — | — | — | — | — |

| Total | — | — | — | — | 541 | 207 |

| Service costs | — | — | — | — | — | — |

| Total remuneration | — | — | — | — | 541 | 207 |

| Dr. R. Cramer (Continental China from August 12, 2009 to August 11, 2017) | ||||||

|---|---|---|---|---|---|---|

| Remuneration granted | Inflows | |||||

| € thousands | 2019 | 2020 | 2020 (Min) | 2020 (Max) | 2019 | 2020 |

| Fixed remuneration | — | — | — | — | — | — |

| Additional benefits | 2 | 2 | 2 | 2 | 2 | 2 |

| Total | 2 | 2 | 2 | 2 | 2 | 2 |

| Performance bonus (immediate payment) | — | — | — | — | — | — |

| Multiannual variable remuneration | — | — | — | — | 541 | 239 |

| Performance bonus (deferral) [3 years] | — | — | — | — | 541 | 239 |

| Long-term incentive [4 years] | — | — | — | — | — | — |

| Total | 2 | 2 | 2 | 2 | 543 | 241 |

| Service costs | — | — | — | — | — | — |

| Total remuneration | 2 | 2 | 2 | 2 | 543 | 241 |

| H.-J. Duensing (ContiTech since May 1, 2015) | ||||||

|---|---|---|---|---|---|---|

| Remuneration granted | Inflows | |||||

| € thousands | 2019 | 2020 | 2020 (Min) | 2020 (Max) | 2019 | 2020 |

| Fixed remuneration | 800 | 773 | 773 | 773 | 800 | 773 |

| Additional benefits | 24 | 23 | 23 | 23 | 24 | 23 |

| Total | 824 | 796 | 796 | 796 | 824 | 796 |

| Performance bonus (immediate payment) | 700 | 700 | 0 | 1,400 | 126 | 140 |

| Multiannual variable remuneration | 1,250 | 1,250 | 0 | 2,500 | 72 | 405 |

| Performance bonus (deferral) [3 years] | 467 | — | — | — | 72 | 312 |

| Performance bonus (deferral) [2020]1 | — | 467 | 0 | 934 | — | 93 |

| Long-term incentive [4 years] | 783 | 783 | 0 | 1,566 | 0 | 0 |

| Total | 2,774 | 2,746 | 796 | 4,696 | 1,022 | 1,341 |

| Service costs | 632 | 691 | 691 | 691 | 632 | 691 |

| Total remuneration | 3,406 | 3,437 | 1,487 | 5,387 | 1,654 | 2,032 |

| F. Jourdan (Autonomous Mobility and Safety since September 25, 2013) | ||||||

|---|---|---|---|---|---|---|

| Remuneration granted | Inflows | |||||

| € thousands | 2019 | 2020 | 2020 (Min) | 2020 (Max) | 2019 | 2020 |

| Fixed remuneration | 800 | 773 | 773 | 773 | 800 | 773 |

| Additional benefits | 29 | 29 | 29 | 29 | 29 | 29 |

| Total | 829 | 802 | 802 | 802 | 829 | 802 |

| Performance bonus (immediate payment) | 700 | 700 | 0 | 1,400 | 126 | 76 |

| Multiannual variable remuneration | 1,250 | 1,250 | 0 | 2,500 | 541 | 149 |

| Performance bonus (deferral) [3 years] | 467 | — | — | — | 541 | 98 |

| Performance bonus (deferral) [2020]1 | — | 467 | 0 | 934 | — | 51 |

| Long-term incentive [4 years] | 783 | 783 | 0 | 1,566 | 0 | 0 |

| Total | 2,779 | 2,752 | 802 | 4,702 | 1,496 | 1,027 |

| Service costs | 642 | 711 | 711 | 711 | 642 | 711 |

| Total remuneration | 3,421 | 3,463 | 1,513 | 5,413 | 2,138 | 1,738 |

| C. Kötz (Tires since April 1, 2019) | ||||||

|---|---|---|---|---|---|---|

| Remuneration granted | Inflows | |||||

| € thousands | 2019 | 2020 | 2020 (Min) | 2020 (Max) | 2019 | 2020 |

| Fixed remuneration | 600 | 773 | 773 | 773 | 600 | 773 |

| Additional benefits | 19 | 17 | 17 | 17 | 19 | 17 |

| Total | 619 | 790 | 790 | 790 | 619 | 790 |

| Performance bonus (immediate payment) | 527 | 700 | 0 | 1,400 | 348 | 79 |

| Multiannual variable remuneration | 1,142 | 1,250 | 0 | 2,500 | 0 | 53 |

| Performance bonus (deferral) [3 years] | 359 | — | — | — | — | — |

| Performance bonus (deferral) [2020]1 | — | 467 | 0 | 934 | — | 53 |

| Long-term incentive [4 years] | 783 | 783 | 0 | 1,566 | 0 | 0 |

| Total | 2,288 | 2,740 | 790 | 4,690 | 967 | 922 |

| Service costs | 708 | 936 | 936 | 936 | 708 | 936 |

| Total remuneration | 2,996 | 3,676 | 1,726 | 5,626 | 1,675 | 1,858 |

| H. Matschi (Vehicle Networking and Information since August 12, 2009) | ||||||

|---|---|---|---|---|---|---|

| Remuneration granted | Inflows | |||||

| € thousands | 2019 | 2020 | 2020 (Min) | 2020 (Max) | 2019 | 2020 |

| Fixed remuneration | 800 | 773 | 773 | 773 | 800 | 773 |

| Additional benefits | 16 | 18 | 18 | 18 | 16 | 18 |

| Total | 816 | 791 | 791 | 791 | 816 | 791 |

| Performance bonus (immediate payment) | 700 | 700 | 0 | 1,400 | 126 | 76 |

| Multiannual variable remuneration | 1,250 | 1,250 | 0 | 2,500 | 541 | 142 |

| Performance bonus (deferral) [3 years] | 467 | — | — | — | 541 | 91 |

| Performance bonus (deferral) [2020]1 | — | 467 | 0 | 934 | — | 51 |

| Long-term incentive [4 years] | 783 | 783 | 0 | 1,566 | 0 | 0 |

| Total | 2,766 | 2,741 | 791 | 4,691 | 1,483 | 1,009 |

| Service costs | 698 | 805 | 805 | 805 | 698 | 805 |

| Total remuneration | 3,464 | 3,546 | 1,596 | 5,496 | 2,181 | 1,814 |

| Dr. A. Reinhart (Group Human Relations since October 1, 2014) | ||||||

|---|---|---|---|---|---|---|

| Remuneration granted | Inflows | |||||

| € thousands | 2019 | 2020 | 2020 (Min) | 2020 (Max) | 2019 | 2020 |

| Fixed remuneration | 800 | 1,063 | 1,063 | 1,063 | 800 | 1,063 |

| Additional benefits | 12 | 14 | 14 | 14 | 12 | 14 |

| Total | 812 | 1,077 | 1,077 | 1,077 | 812 | 1,077 |

| Performance bonus (immediate payment) | 700 | 700 | 0 | 1,400 | 126 | 76 |

| Multiannual variable remuneration | 1,250 | 1,360 | 0 | 2,720 | 541 | 290 |

| Performance bonus (deferral) [3 years] | 467 | — | — | — | 541 | 239 |

| Performance bonus (deferral) [2020]1 | — | 467 | 0 | 934 | — | 51 |

| Long-term incentive [4 years] | 783 | 893 | 0 | 1,786 | 0 | 0 |

| Total | 2,762 | 3,137 | 1,077 | 5,197 | 1,479 | 1,443 |

| Service costs | 776 | 920 | 920 | 920 | 776 | 920 |

| Total remuneration | 3,538 | 4,057 | 1,997 | 6,117 | 2,255 | 2,363 |

| W. Schäfer (Group Finance and Controlling since January 1, 2010) | ||||||

|---|---|---|---|---|---|---|

| Remuneration granted | Inflows | |||||

| € thousands | 2019 | 2020 | 2020 (Min) | 2020 (Max) | 2019 | 2020 |

| Fixed remuneration | 1,100 | 1,063 | 1,063 | 1,063 | 1,100 | 1,063 |

| Additional benefits | 10 | 17 | 17 | 17 | 10 | 17 |

| Total | 1,110 | 1,080 | 1,080 | 1,080 | 1,110 | 1,080 |

| Performance bonus (immediate payment) | 700 | 700 | 0 | 1,400 | 126 | 76 |

| Multiannual variable remuneration | 1,360 | 1,360 | 0 | 2,720 | 541 | 290 |

| Performance bonus (deferral) [3 years] | 467 | — | — | — | 541 | 239 |

| Performance bonus (deferral) [2020]1 | — | 467 | 0 | 934 | — | 51 |

| Long-term incentive [4 years] | 893 | 893 | 0 | 1,786 | 0 | 0 |

| Total | 3,170 | 3,140 | 1,080 | 5,200 | 1,777 | 1,446 |

| Service costs | 741 | 844 | 844 | 844 | 741 | 844 |

| Total remuneration | 3,911 | 3,984 | 1,924 | 6,044 | 2,518 | 2,290 |

| A. Wolf (Powertrain since June 3, 2020) | ||||||

|---|---|---|---|---|---|---|

| Remuneration granted | Inflows | |||||

| € thousands | 2019 | 2020 | 2020 (Min) | 2020 (Max) | 2019 | 2020 |

| Fixed remuneration | — | 448 | 448 | 448 | — | 448 |

| Additional benefits | — | 8 | 8 | 8 | — | 8 |

| Total | — | 456 | 456 | 456 | — | 456 |

| Performance bonus (immediate payment) | — | 406 | 0 | 811 | — | 180 |

| Multiannual variable remuneration | — | 724 | 0 | 1,449 | — | 120 |

| Performance bonus (deferral) [3 years] | — | — | — | — | — | 0 |

| Performance bonus (deferral) [2020]1 | — | 270 | 0 | 541 | — | 120 |

| Long-term incentive [4 years] | — | 454 | 0 | 908 | — | 0 |

| Total | — | 1,586 | 456 | 2,716 | — | 756 |

| Service costs | — | 244 | 244 | 244 | — | 244 |

| Total remuneration | — | 1,830 | 700 | 2,960 | — | 1,000 |

1 From the net inflow of the performance bonus, shares of Continental AG with a value of 20% of the gross payout amount must be purchased and held for a period of three years; the corresponding gross amount was calculated assuming a tax and contribution ratio of 50% flat.

Dr. Ralf Cramer, who left the Executive Board on August 11, 2017, still received subsequent additional benefits of €2 thousand and payments from the long-term component of the 2016 performance bonus in the amount of €239 thousand in 2020. José A. Avila, who left the Executive Board on September 30, 2018, was paid €207 thousand from the long-term component of the 2016 performance bonus in 2020. In addition, on the basis of his employment contract that ended as planned on December 31, 2019, he was also paid a further €126 thousand as an immediate component of the performance bonus and €84 thousand as a long-term component of the performance bonus in virtual shares of the company in 2020.

The disclosures on benefits granted and inflows are broken down into fixed and variable remuneration components and supplemented by disclosures on the service costs. The fixed remuneration components include the non-performance-related fixed remuneration and additional benefits. The variable performance-related remuneration components consist of the immediate payment from the performance bonus as a short-term remuneration component and the two long-term components: the deferral of the performance bonus and LTI. Due to the changeover of the remuneration system, the part of the performance bonus that is part of the multiannual variable remuneration is broken down into the “three-year deferral” as set out in the 2019 remuneration system and the “2020 deferral” as set out in the remuneration system in place since January 1, 2020.

The tables above take into account the reference tables recommended in Section 4.2.5 (3) of the German Corporate Governance Code as amended on February 7, 2017 (“DCGK 2017”) and show, separately for each member of the Executive Board, the benefits granted in fiscal 2020 and fiscal 2019 as well as the payments made (“inflow”). The immediate payment, both deferrals and the LTI are each recognized as remuneration granted at the value of the commitment at the time it is granted (equivalent to 100% target achievement). The remuneration elements are supplemented by disclosures on individually attainable maximum and minimum remuneration.

The inflow recognized in the year under review comprises the fixed remuneration components actually received plus the amounts of the immediate payment to be received in the following year that had been determined at the time the remuneration report was prepared. The “three-year deferral” covers the amounts from the long-term component of the 2016 performance bonus that were paid out in 2020. The “2020 deferral” refers to the amount paid out at the time the remuneration report was prepared as an amount to be converted for equity deferral into shares of the company and is paid out the following year. The gross payout amount is disclosed, which, assuming a tax and contribution ratio of 50% flat, must be employed to meet the conversion obligation of the Executive Board member. Inflows from multiannual variable remuneration (LTI tranches from 2016/2019 onward) that were scheduled to end in the period under review are not paid until the following year. In line with the recommendations of Section 4.2.5 (3) DCGK 2017, service costs in the disclosures on inflows correspond to the amounts granted, although they do not represent actual inflows in a stricter sense.

Given the economic strain as a result of the coronavirus crisis and out of solidarity with the employees affected by short-time work and other restrictions, the Executive Board resolved, with the approval of the Supervisory Board, a reduction in its monthly fixed remuneration of 10% for April to July 2020.

In fiscal 2020, the members of the Executive Board neither received nor were promised payments by a third party with respect to their activities on the Executive Board.

| Remuneration of the Executive Board in 2020 | |||||

|---|---|---|---|---|---|

| Remuneration components | |||||

| € thousands | Fixed1 | Variable, short-term | Variable, long-term2 | Total | Share-based payment3 |

| N. Setzer | 843 | 84 | 903 | 1,830 | 803 |

| 1,301 | 0 | 355 | 1,656 | 428 | |

| H.-J. Duensing | 796 | 140 | 876 | 1,812 | 705 |

| F. Jourdan | 802 | 76 | 834 | 1,712 | 716 |

| C. Kötz | 790 | 79 | 836 | 1,705 | 762 |

| H. Matschi | 791 | 76 | 834 | 1,701 | 754 |

| Dr. A. Reinhart | 1,077 | 76 | 944 | 2,097 | 811 |

| W. Schäfer | 1,080 | 76 | 944 | 2,100 | 811 |

| A. Wolf (since June 3, 2020) | 456 | 180 | 574 | 1,210 | 381 |

| Total | 7,936 | 787 | 7,100 | 15,823 | 6,171 |

1 In addition to cash components, the fixed remuneration includes non-cash elements, such as benefits relating to international assignments and in particular any related taxes paid, company cars and insurance.

2 Long-term component of variable remuneration that must be invested as a deferral in company shares to be held for a period of three years to ensure a focus on the sustainable development of the company, and benefits granted under the 2020 long-term incentive plan.

3 Benefits granted under the 2020 long-term incentive plan, and changes in the value of virtual shares granted in previous years and in the value of the 2017 to 2020 long-term incentive plans.

| Remuneration of the Executive Board in 2019 | |||||

|---|---|---|---|---|---|

| Remuneration components | |||||

| € thousands | Fixed1 | Variable, short-term | Variable, long-term2 | Total | Share-based payment3 |

| 1,471 | 270 | 1,730 | 3,471 | -1,493 | |

| H.-J. Duensing | 824 | 126 | 867 | 1,817 | -737 |

| F. Jourdan | 829 | 126 | 867 | 1,822 | -681 |

| C. Kötz (since April 1, 2019) | 619 | 348 | 1,015 | 1,982 | 127 |

| H. Matschi | 816 | 126 | 867 | 1,809 | -755 |

| Dr. A. Reinhart | 812 | 126 | 867 | 1,805 | -688 |

| W. Schäfer | 1,110 | 126 | 977 | 2,213 | -824 |

| N. Setzer | 819 | 209 | 923 | 1,951 | -649 |

| Total | 7,300 | 1,457 | 8,113 | 16,870 | -5,700 |

1 In addition to cash components, the fixed remuneration includes non-cash elements, such as benefits relating to international assignments and in particular any related taxes paid, company cars and insurance.

2 Long-term component of variable remuneration that is converted into virtual shares of Continental AG to ensure a focus on the sustainable development of the company, and benefits granted under the 2019 long-term incentive plan.

3 Long-term component of variable remuneration that is converted into virtual shares of Continental AG to ensure a focus on the sustainable development of the company, benefits granted under the 2019 long-term incentive plan, and changes in the value of virtual shares granted in previous years and in the value of the 2016 to 2019 long-term incentive plans.

Share-based payment – performance bonus (deferral) [three-year]

The amounts of variable remuneration converted into virtual shares of Continental AG for members of the Executive Board as set out in the 2019 remuneration system changed as follows:

| units | Number of shares as at Dec. 31, 2018 | Payment | Commitments | Number of shares as at Dec. 31, 2019 | Payment | Commitments | Number of shares as at Dec. 31, 2020 |

| N. Setzer | 8,212 | -3,316 | 2,228 | 7,124 | -3,023 | 1,689 | 5,790 |

| Dr. E. Degenhart (until November 30, 2020) | 16,307 | -5,836 | 3,512 | 13,983 | -4,252 | 2,184 | 11,915 |

| J. A. Avila (until September 30, 2018) | 8,771 | -3,471 | 883 | 6,183 | -2,188 | — | 3,995 |

| Dr. R. Cramer (until August 11, 2017) | 7,772 | -3,471 | — | 4,301 | -2,528 | — | 1,773 |

| H.-J. Duensing | 6,211 | -465 | 682 | 6,428 | -3,293 | 1,020 | 4,155 |

| F. Jourdan | 7,619 | -3,471 | 1,475 | 5,623 | -1,036 | 1,020 | 5,607 |

| C. Kötz (since April 1, 2019) | — | — | — | — | 0 | 2,816 | 2,816 |

| H. Matschi | 7,115 | -3,471 | 4,689 | 8,333 | -964 | 1,020 | 8,389 |

| Dr. A. Reinhart | 8,901 | -3,471 | 1,640 | 7,070 | -2,528 | 1,020 | 5,562 |

| W. Schäfer | 8,901 | -3,471 | 1,640 | 7,070 | -2,528 | 1,020 | 5,562 |

| H.-G. Wente (until April 30, 2015) | 228 | -228 | — | — | — | — | — |

| Total | 80,037 | -30,671 | 16,749 | 66,115 | -22,340 | 11,789 | 55,564 |

| € thousands | Fair value as at Dec. 31, 2018 | Fair value of distribution | Change in fair value | Fair value of commitments | Fair value as at Dec. 31, 2019 | Fair value of distribution | Change in fair value | Fair value of commitments | Fair value as at Dec. 31, 2020 |

| N. Setzer | 1,093 | -517 | 62 | 266 | 904 | -286 | -75 | 202 | 745 |

| Dr. E. Degenhart (until November 30, 2020) | 2,181 | -909 | 107 | 418 | 1,797 | -403 | -98 | 261 | 1,557 |

| J. A. Avila (until September 30, 2018) | 1,171 | -541 | 66 | 105 | 801 | -207 | -61 | 0 | 533 |

| Dr. R. Cramer (until August 11, 2017) | 1,037 | -541 | 67 | 0 | 563 | -239 | -85 | 0 | 239 |

| H.-J. Duensing | 828 | -72 | -4 | 81 | 833 | -312 | -102 | 121 | 540 |

| F. Jourdan | 1,019 | -541 | 69 | 176 | 723 | -98 | -15 | 121 | 731 |

| C. Kötz (since April 1, 2019) | — | — | — | — | — | 0 | 0 | 336 | 336 |

| H. Matschi | 952 | -541 | 70 | 559 | 1,040 | -91 | 26 | 121 | 1,096 |

| Dr. A. Reinhart | 1,191 | -541 | 65 | 195 | 910 | -239 | -64 | 121 | 728 |

| W. Schäfer | 1,193 | -541 | 65 | 195 | 912 | -239 | -64 | 121 | 730 |

| H.-G. Wente (until April 30, 2015) | 29 | -36 | 7 | 0 | 0 | — | — | — | — |

| Total | 10,694 | -4,780 | 574 | 1,995 | 8,483 | -2,114 | -538 | 1,404 | 7,235 |

As at December 31, 2020, there are no longer any commitments for Heinz-Gerhard Wente, who retired on April 30, 2015. Dr. Ralf Cramer, who was a member of the Executive Board until August 11, 2017, was paid commitments of €239 thousand (equivalent to 2,528 units) in 2020. As at December 31, 2020, there were commitments with a fair value of €239 thousand (equivalent to 1,773 units). José A. Avila, who left the Executive Board on September 30, 2018, was paid commitments of €207 thousand (equivalent to 2,188 units) in 2020. As at December 31, 2020, there were commitments with a fair value of €533 thousand (equivalent to 3,995 units). Dr. Elmar Degenhart, who left the Executive Board on November 30, 2020, was paid commitments of €403 thousand (equivalent to 4,252 units) in 2020. As at December 31, 2020, there were commitments with a fair value of €1,557 thousand (equivalent to 11,915 units).

Owing to the individual arrangements specific to the company, there are certain features of the virtual shares as compared to standard options that must be taken into account in their measurement.

A Monte Carlo simulation is used in the measurement of stock options. This means that log-normal distributed processes are simulated for the price of Continental shares. The measurement model also takes into account the average value accumulation of share prices in the respective reference period, the dividends paid, and the floor and cap for the payment amount.

The following parameters for the performance bonus were used as at the measurement date of December 31, 2020:

- Constant zero rates as at the measurement date of December 31, 2020:

2017 tranche: -0.74% as at the due date and as at the expected payment date;

2018 tranche: -0.74% as at the due date and as at the expected payment date;

2019 tranche: -0.76% as at the due date and as at the expected payment date. - Interest rate based on the yield curve for government bonds.

- Dividend payments as the arithmetic mean based on publicly available estimates for 2021 and 2022; the paid dividend of Continental AG amounted to €3.00 per share in 2020, and Continental AG distributed a dividend of €4.75 per share in 2019.

- Historical volatilities on the basis of daily Xetra closing rates for Continental shares based on the respective remaining term for virtual shares. The volatility for the 2017 tranche is 37.04%, for the 2018 tranche 48.36% and for the 2019 tranche 41.89%.

Share-based payment – long-term incentive (LTI plans starting with 2018)

The LTI plans starting with 2018 developed as follows:

| € thousands | Fair value as at Dec. 31, 20181 | 2019 LTI plan commitment | Change in fair value | Fair value as at Dec. 31, 20191 | 2020 LTI plan commitment | Change in fair value | Fair value as at Dec. 31, 20201 |

| N. Setzer | 800 | 783 | -1,583 | 0 | 847 | -135 | 712 |

| Dr. E. Degenhart (until November 30, 2020)2 | 1,699 | 1,550 | -3,249 | 0 | 355 | -56 | 299 |

| J. A. Avila (until September 30, 2018)3 | 800 | — | -800 | 0 | — | — | 0 |

| Dr. R. Cramer (until August 11, 2017) | 357 | — | -357 | 0 | — | — | 0 |

| H.-J. Duensing | 800 | 783 | -1,583 | 0 | 783 | -125 | 658 |

| F. Jourdan | 800 | 783 | -1,583 | 0 | 783 | -125 | 658 |

| C. Kötz (since April 1, 2019)4 | 105 | 783 | -888 | 0 | 783 | -125 | 658 |

| H. Matschi | 800 | 783 | -1,583 | 0 | 783 | -125 | 658 |

| Dr. A. Reinhart | 800 | 783 | -1,583 | 0 | 893 | -142 | 751 |

| W. Schäfer | 936 | 893 | -1,829 | 0 | 893 | -142 | 751 |

| H.-G. Wente (until April 30, 2015) | 33 | — | -33 | 0 | — | — | 0 |

| A. Wolf (since June 3, 2020) | — | — | — | — | 454 | -73 | 381 |

| Total | 7,930 | 7,141 | -15,071 | 0 | 6,574 | -1,048 | 5,526 |

1 As at the end of the reporting period, the 2020 tranche was vested at 25%, the 2019 tranche at 50%, the 2018 tranche at 75% and the 2017 tranche at 100%.

2 With the departure of Dr. E. Degenhart as at November 30, 2020, a portion of the commitments of the 2017, 2018 and 2019 LTI plans expired. The commitment in 2017 fell from €1,550 thousand to €1,517 thousand, the commitment in 2018 fell from €1,550 thousand to €1,130 thousand, and the commitment in 2019 fell from €1,550 thousand to €743 thousand. This did not result in any change to fair value, since all tranches have a fair value of €0.

3 With the termination of the employment contract of J. A. Avila as at December 31, 2019, a portion of the 2017, 2018 and 2019 LTI plans expired. All remaining pro rata tranches had a fair value of €0 as at December 31, 2020.

4 C. Kötz remains entitled to LTI plans that were granted to him as a senior executive between 2016 and 2018.

A Monte Carlo simulation is used in the measurement of the TSR target criterion. This means that log-normal distributed processes are simulated for the price of Continental shares. The Monte Carlo simulation takes into account the average value accumulation of share prices in the respective reference period, the TSR dividends paid and the restriction for the payment amount.

The following TSR parameters were used as at the measurement date of December 31, 2020:

- Constant zero rates as at the measurement date of December 31, 2020:

2017 LTI plan: -0.73% as at the payment date;

2018 LTI plan: -0.73% as at the due date and -0.74% as at the expected payment date;

2019 LTI plan: -0.75% as at the due date and -0.76% as at the expected payment date;

2020 LTI plan: -0.76% as at the due date and -0.77% as at the expected payment date. - Interest rate based on the yield curve for government bonds.

- Dividend payments as the arithmetic mean based on publicly available estimates for 2021 until 2023; the paid dividend of Continental AG amounted to €3.00 per share in 2020, and Continental AG distributed a dividend of €4.75 per share in 2019. Continental AG 2020 Annual Report To Our Shareholders Corporate Governance 39

- Historical volatilities on the basis of daily Xetra closing rates for Continental shares and the benchmark index based on the respective remaining term for LTI tranches. The volatility for the 2018 LTI plan is 53.65% and for the 2019 LTI plan 43.12%. For the 2020 LTI plan, this is 39.30% for the Continental share and 31.21% for the benchmark index.

- Historical correlations on the basis of daily Xetra closing rates for the benchmark index based on the respective remaining term of the components of the 2020 LTI plan. For the 2020 LTI plan, the historical correlation is 0.8632.

Expenses for retirement benefits

The defined benefit obligations for all pension commitments for the active members of the Executive Board in 2020 are presented below:

| Defined benefit obligations | ||

| € thousands | December 31, 2020 | December 31, 2019 |

| N. Setzer | 10,129 | 7,844 |

| Dr. E. Degenhart (until November 30, 2020) | 19,088 | 16,167 |

| H.-J. Duensing | 4,608 | 3,572 |

| F. Jourdan | 6,308 | 5,067 |

| C. Kötz (since April 1, 2019) | 1,899 | 748 |

| H. Matschi | 9,927 | 8,181 |

| Dr. A. Reinhart | 7,431 | 5,562 |

| W. Schäfer | 14,618 | 12,548 |

| A. Wolf (since June 3, 2020) | 446 | — |

| Total | 74,454 | 59,689 |

Please see Note 41 of the notes to the consolidated financial statements for details of pension obligations for former members of the Executive Board.

Remuneration of the Supervisory Board

On the basis of ARUG II, Section 113 (3) AktG has been rewritten. In accordance with this, a resolution of the Annual Shareholders’ Meeting is made at least once every four years on the remuneration of the Supervisory Board members.

In light of this, and with the support of an independent consultant, a new remuneration system was developed for the members of the Supervisory Board and resolved separately in each case by the Executive Board and the Supervisory Board.

The new remuneration system was then resolved by the Annual Shareholders’ Meeting of Continental AG on July 14, 2020. It has been valid since January 1, 2020.

In accordance with the new remuneration system, the remuneration of the members of the Supervisory Board no longer includes any variable remuneration components, but rather exclusively consists of fixed remuneration components. The switch to an exclusively fixed remuneration system facilitates advising and monitoring geared toward the sustainable development of the company and also corresponds to Suggestion G.18 Sentence 1 of the German Corporate Governance Code. From the perspective of Continental AG, an exclusively fixed remuneration is more suited to strengthening the independence of the members of the Supervisory Board and ensuring their remuneration is proportionate to the work carried out.

The removal of the variable remuneration component makes it necessary – in order to ensure that the remuneration level remains the same as it is now – to increase the yearly fixed remuneration of a Supervisory Board member from €75,000 as it stands now to €180,000. For the chairman and vice chairperson of the Supervisory Board, as well as the chairperson and members of a committee, there are also plans to increase the level of remuneration in the future. This will be three times the regular fixed remuneration of a Supervisory Board member for the chairman of the Supervisory Board, 2.5 times as much for the chairman of the Audit Committee, two times as much for the chairperson of another committee, and 1.5 times as much for the vice chairperson of the Supervisory Board and for the members of a committee.

In addition, each Supervisory Board member shall receive meetingattendance fees of €1,000 for each Supervisory Board meeting that the member attends in person. This shall apply, mutatis mutandis, to personal attendance of committee meetings that do not take place on the same day as a Supervisory Board meeting. The members of the Supervisory Board shall also have their cash expenses reimbursed, in addition to the value added tax incurred by them for activities relating to Supervisory Board work.

The amount and structure of the future remuneration of the Supervisory Board members of Continental AG is in line with the market when compared with the remuneration of Supervisory Board members in other DAX 30 companies. Continental AG assumes that the remuneration of the Supervisory Board members – with the exception of the reduced remuneration of an ordinary member of a committee – will remain largely unchanged despite the proposed structural adjustments.

The Annual Shareholders’ Meeting will make a resolution on the remuneration of the Supervisory Board members at least once every four years in the future, with an affirmative resolution permitted. For the purpose of this presentation to the Annual Shareholders’ Meeting, the remuneration system will be subject to a timely review.

Given the economic strain as a result of the coronavirus crisis and out of solidarity with the employees affected by short-time work and other restrictions, the members of the Supervisory Board accepted a 10% reduction in their annual fixed remuneration on a pro rata basis for April to July 2020.

The remuneration of individual Supervisory Board members in 2020 as provided for under these arrangements is shown in the following table:

| Remuneration of the Supervisory Board | |||

|---|---|---|---|

| Remuneration components | |||

| 2020 | 2019 | ||

| € thousands | Fixed1 | Fixed1 | Variable |

| Prof. Dr.-Ing. Wolfgang Reitzle | 526 | 234 | 156 |

| Hasan Allak (since April 26, 2019)2 | 183 | 57 | 35 |

| Christiane Benner2 | 269 | 119 | 78 |

| Dr. Gunter Dunkel | 184 | 82 | 52 |

| Francesco Grioli2 | 269 | 122 | 78 |

| Prof. Dr.-Ing. Peter Gutzmer (until April 26, 2019) | — | 25 | 16 |

| Michael Iglhaut2 | 265 | 122 | 78 |

| Satish Khatu (since April 26, 2019) | 179 | 57 | 35 |

| Isabel Corinna Knauf (since April 26, 2019) | 183 | 57 | 35 |

| Prof. Dr. Klaus Mangold (until April 26, 2019) | — | 26 | 16 |

| Sabine Neuß | 174 | 82 | 52 |

| Prof. Dr. Rolf Nonnenmacher | 439 | 199 | 130 |

| Dirk Nordmann2 | 272 | 122 | 78 |

| Lorenz Pfau (since April 26, 2019)2 | 182 | 57 | 35 |

| Klaus Rosenfeld | 272 | 122 | 78 |

| Georg F. W. Schaeffler | 264 | 124 | 78 |

| Maria-Elisabeth Schaeffler-Thumann | 174 | 121 | 78 |

| Jörg Schönfelder2 | 271 | 120 | 78 |

| Stefan Scholz2 | 182 | 82 | 52 |

| Gudrun Valten (until April 26, 2019)2 | — | 25 | 16 |

| Elke Volkmann2 | 181 | 82 | 52 |

| Kirsten Vörkel2 | 183 | 82 | 52 |

| Erwin Wörle (until April 26, 2019)2 | — | 25 | 16 |

| Prof. TU Graz e.h. KR Ing. Siegfried Wolf | 174 | 80 | 52 |

| Total | 4,826 | 2,224 | 1,426 |

1 Including meeting-attendance fees.

2 In accordance with the guidelines issued by the German Federation of Trade Unions, these employee representatives have declared that their board remuneration is transferred to the Hans Böckler Foundation and in one case to other institutions as well.