Forecast process

In January 2019, Continental announced its initial expectations regarding the most important production and sales markets for the new fiscal year. This formed the basis of our forecast for the corporation’s key performance indicators, which we published at the same time. These included sales and the adjusted EBIT margin for the corporation. In addition, we provided information on the assessment of important factors influencing EBIT. These included the expected negative or positive effect of the estimated development of raw materials prices for the current year, the expected development of special effects and the amount of amortization from purchase price allocations. We thus allowed investors, analysts and other interested parties to estimate the corporation’s expected EBIT. Furthermore, we published an assessment of the development of interest income and expenses as well as the tax rate for the corporation, which in turn allowed the corporation’s expected net income to be estimated. We also published a forecast of the capital expenditures planned for the current year and the EBIT before acquisitions and the effects of transforming the Powertrain division into an independent legal entity.

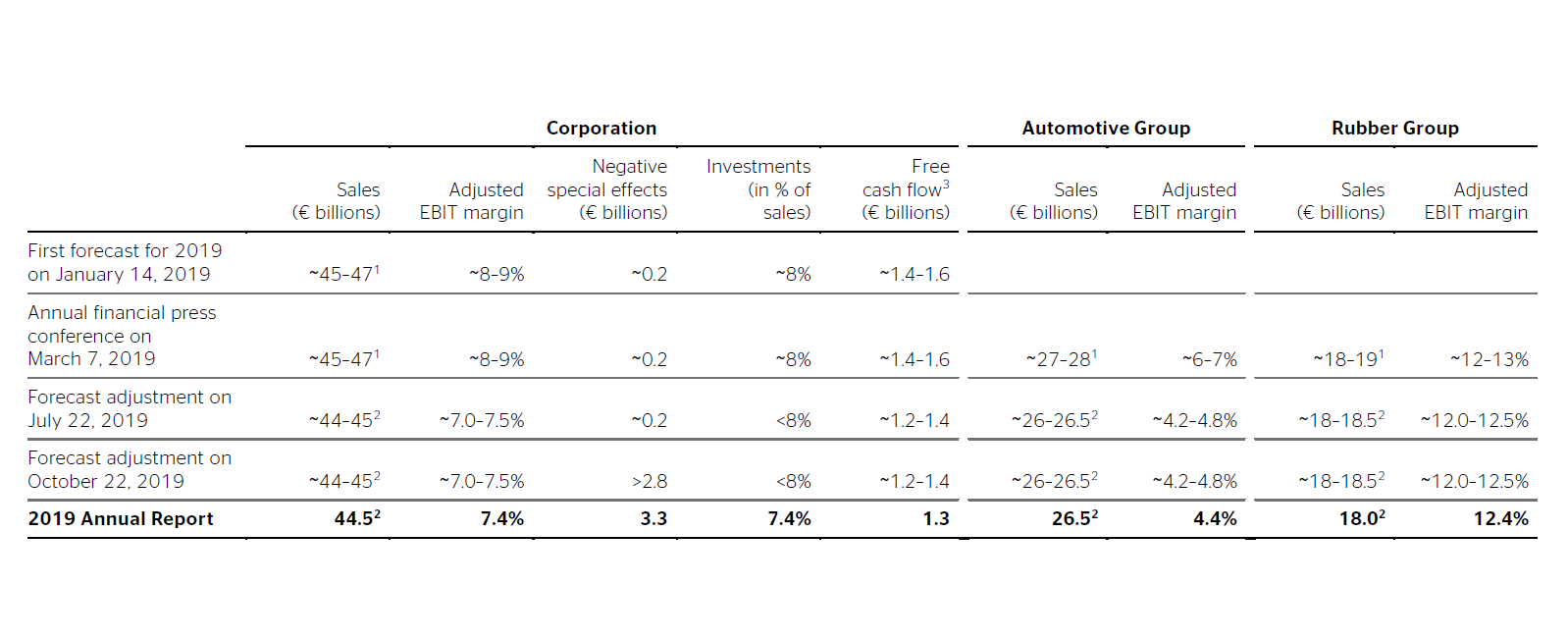

In the 2018 Annual Report, we supplemented this forecast for the corporation with a forecast of the sales and adjusted EBIT margins of the two core business areas: the Automotive Group and the Rubber Group. We then published this forecast in March 2019 as part of our annual financial press conference and the publication of our annual report for 2018.

Our forecast for the current year, like every year, was reviewed continually. Possible changes to the forecast were described at the latest in the financial report for the respective quarter.

The medium-term forecast prepared by Continental in 2015 had to be withdrawn at the end of July 2019 due to the strong and foreseeable sustained decrease in global vehicle production. Continental currently expects that the global production of passenger cars and light commercial vehicles weighing less than 6 metric tons will not increase substantially until 2024.

Comparison of the past fiscal year against forecast

Our original forecast for fiscal 2019, which we published in full in March 2019, was based on the expectation that the global production of passenger cars and light commercial vehicles would be at roughly the same level as in 2018. At the same time, we anticipated that global demand for replacement tires for passenger cars and light commercial vehicles would grow by 2%.

Based on these market assumptions – and provided that exchange rates remained constant – we anticipated total sales of between around €45 billion and €47 billion and an adjusted EBIT margin of approximately 8% to 9% in fiscal 2019. For the Automotive Group, assuming constant exchange rates, we anticipated sales of approximately €27 billion to €28 billion with an adjusted EBIT margin of around 6% to 7%. For the Rubber Group, assuming constant exchange rates and an adverse effect from rising raw material prices of around €50 million, we anticipated sales of approximately €18 billion to €19 billion with an adjusted EBIT margin of around 12% to 13%. In 2019, we expected the negative financial result before effects from currency translation, effects from changes in the fair value of derivative instruments, and other valuation effects to be in the region of €220 million. The tax rate – including the tax effects of transforming the Powertrain division into an independent legal entity – was expected to be around 27% in 2019. For 2019, taking into account expenses relating to the transformation of the Powertrain division into an independent legal entity, we expected negative special effects to total €200 million. The amortization of purchase price allocations was forecast at around €200 million. The capital expenditure ratio before financial investments was estimated at about 8% of sales due to the recognition of leases as a result of the first-time adoption of IFRS 16. Free cash flow before acquisitions and before the effects of transforming the Powertrain division into an independent legal entity was expected to total around €1.4 billion to €1.6 billion. All aspects of the forecast were confirmed in the reporting on the first quarter of 2019.

On July 22, 2019, we announced that a number of factors had led to an adjustment of the forecast for fiscal 2019. Specifically, these were lower sales expectations for the second half of 2019 due to the decline in global production of passenger cars and light commercial vehicles, reduced volumes for certain products of the Automotive Group as a result of changes in customer demand, and potential warranty claims in the Automotive Group.

The forecast for consolidated sales in 2019 – assuming constant exchange rates compared with the first half of 2019 – was reduced to around €44 billion to €45 billion, while the forecast for the corporation’s adjusted EBIT margin was lowered to a range of around 7.0% to 7.5%. The expectation for sales in the Automotive Group was reduced to around €26 billion to €26.5 billion, and the adjusted EBIT margin was specified in the range of around 4.2% to 4.8%. The sales forecast for the Rubber Group was narrowed to roughly €18 billion to €18.5 billion, and the adjusted EBIT margin was specified in the range of around 12.0% to 12.5%. The capital expenditure ratio before financial investments, including IFRS 16, was adjusted to below 8% of sales. Free cash flow before acquisitions, including IFRS 16 and before the effects of transforming the Powertrain division into an independent legal entity, was then expected to be in the range of around €1.2 billion to €1.4 billion. All other elements of the previous forecast remained unchanged.

On October 22, 2019, we announced that an impairment of around €2.5 billion would be recognized in the third quarter of 2019. This impairment mainly resulted from the assumption that global production of passenger cars and light commercial vehicles was not expected to increase substantially until 2024. There were also restructuring provisions of €97 million in the first nine months of 2019, which were incurred in the scope of the Transformation 2019–2029 structural program announced on September 25, 2019 Further expenses for restructuring provisions related to this program were expected to be recognized in the fourth quarter of 2019. The impairment and the restructuring provisions did not affect the key financial indicators used in the outlook for 2019. But after incurring around €200 million in negative special effects and taking into account expenses relating to the transformation of the Powertrain division into an independent legal entity, we then anticipated negative special effects of at least €2.8 billion for fiscal 2019. All other elements of the revised forecast from July 22, 2019 were confirmed.

Continental achieved consolidated sales of €44.5 billion and a consolidated adjusted EBIT margin of 7.4% in fiscal 2019. The Automotive Group generated sales of €26.5 billion and an adjusted EBIT margin of 4.4%. The Rubber Group generated sales of €18.0 billion and an adjusted EBIT margin of 12.4%.

The negative financial result before effects from currency translation, effects from changes in the fair value of derivative instruments, and other valuation effects decreased to €170.1 million in 2019, which was below our forecast of around €220 million from January 2019.

Negative special effects for fiscal 2019, including the restructuring provisions recognized in the fourth quarter, totaled €3.3 billion.

Despite the negative earnings before tax of €588.6 million, income tax expense amounted to €582.4 million in the reporting year because the goodwill impairment and the expenses associated with the transformation of the Powertrain division into an independent legal entity were mostly not tax deductible.

The capital expenditure ratio increased to 7.4% in 2019. This increase was chiefly attributable to the recognition of leases as a result of the first-time adoption of IFRS 16.

Free cash flow before acquisitions and before the effects of transforming the Powertrain division into an independent legal entity amounted to €1.3 billion in 2019. This metric was therefore within the reduced range from July 22, 2019.

Order situation

The order situation in the Automotive Group was noticeably weaker in the reporting period compared with the previous year due to the global decline in demand for passenger cars. Incoming orders for the three Automotive divisions were therefore well below the record levels achieved in the two previous years. Altogether, the Chassis & Safety, Powertrain and Interior divisions acquired orders for a total value of roughly €33 billion for the entire duration of the deliveries. These lifetime sales are based primarily on assumptions regarding production volumes of the respective vehicle or engine platforms, the agreed cost reductions and the development of key raw materials prices. The volume of orders calculated in this way represents a reference point for the resultant sales achievable in the medium term that may, however, be subject to deviations if these factors change. Should the assumptions prove to be accurate, the lifetime sales are a good indicator for the sales volumes that can be achieved in the Automotive Group in four to five years.

The replacement tire business accounts for a large portion of the Tire division’s sales, which is why it is not possible to calculate a reliable figure for order volumes. The same applies to the ContiTech division, which has seven business units operating in various markets and industrial sectors, each in turn with their own relevant factors. Consolidating the order figures from the various ContiTech business units would thus be meaningful only to a limited extent.

Comparison of fiscal 2019 against forecast

Comparison of fiscal 2019 against forecast

1 Assuming exchange rates remain constant year-on-year.

2 Reported sales including exchange-rate effects. The positive exchange-rate effect on the corporation’s sales amounted to €648 million in 2019. Around two-thirds of this was attributable to the Automotive Group, and the other third to the Rubber Group.

3 Before acquisitions and the effects of transforming the Powertrain division into an independent legal entity.

Outlook for fiscal 2020

For 2020, we do not anticipate any recovery in the economic environment. We expect global production of passenger cars and light commercial vehicles to decline for the third successive in succession. Global automotive production is expected to decrease by around 2% to 5% year-on-year in 2020. From today’s perspective, the decline in incoming orders suggests the global production of medium and heavy commercial vehicles is likely to slump by 10% to 15% compared to the previous year in 2020. These estimates take into account the expected impact of the coronavirus on production volumes in the first quarter of 2020. We currently assume that production will decline by more than 10% year-on-year. In China, the decrease is likely to be at least 30% in this period. Our market forecast does not, however, include possible further disruptions to production and the supply chain as well as demand as a result of the continuing spread of the coronavirus. Such disruptions cannot be gauged at the current time.

Based on these production assumptions, we currently expect our Automotive divisions to realize sales of around €25.5 billion to €26.5 billion for the 2020 fiscal year – net of changes in the scope of consolidation and assuming constant exchange rates – and an adjusted EBIT margin of around 3% to 4%. The planned spin-off of Vitesco Technologies in the course of the second half of 2020 has not yet been taken into account and would – depending on the timing of the spin-off – lead to a correspondingly lower sales target for our Automotive divisions and the Continental Corporation.

We expect our Rubber divisions to achieve sales of around €17 billion to €18 billion – assuming constant exchange rates – and an adjusted EBIT margin of around 10% to 11% in fiscal 2020. In addition to the aforementioned production assumptions for the vehicle manufacturer business, the basis for this is our forecasts for the development of replacement-tire markets. We expect a decline of 0% to 2% in global demand for replacement tires for both passenger cars and light commercial vehicles as well as medium and heavy commercial vehicles in 2020. We also anticipate a further weakening of the industrial business, which will affect our ContiTech business area. For our Rubber divisions, we anticipate higher fixed costs, depreciation and amortization in 2020. These increases result primarily from the considerable expansion of capacity in recent years in the Tire division. The utilization of the new capacity and the generation of related sales will lead to economies of scale only in the upcoming years when the utilization of the new plants’ capacity increases. We expect the intense competitive pressure, particularly in the European market, to continue amid rising wage costs. From our perspective, raw material prices are likely to remain roughly unchanged in fiscal 2020 compared with the previous year.

We expect the Continental Corporation to achieve total sales – assuming constant exchange rates – in the range of around €42.5 billion to €44.5 billion and an adjusted EBIT margin of around 5.5% to 6.5% in fiscal 2020.

For 2020, taking into account expenses relating to the Transformation 2019–2029 structural program, among other factors, we expect negative special effects to total around €600 million.

Amortization from purchase price allocations is again expected to total approximately €200 million and affect mainly the ContiTech and Vehicle Networking and Information (until December 31, 2019: primarily the Interior division) business areas.

In 2020, we expect the negative financial result to be in the region of €200 million before effects from currency translation, effects from changes in the fair value of derivative instruments, and other valuation effects. The tax rate is expected to be around 27% in 2020.

The capital expenditure ratio is expected to be around 7.5% of sales in fiscal 2020.

In 2020, we are planning on free cash flow of approximately €0.7 billion to €1.1 billion, before acquisitions and before the effects of transforming the Powertrain division into an independent legal entity.